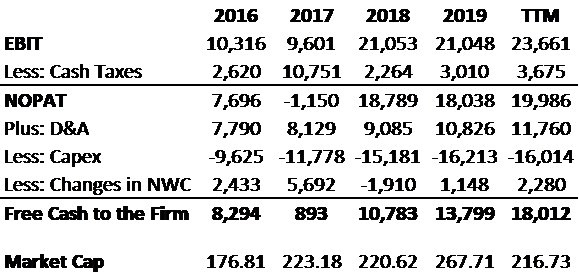

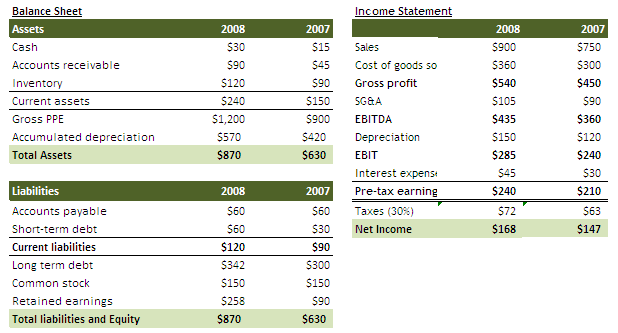

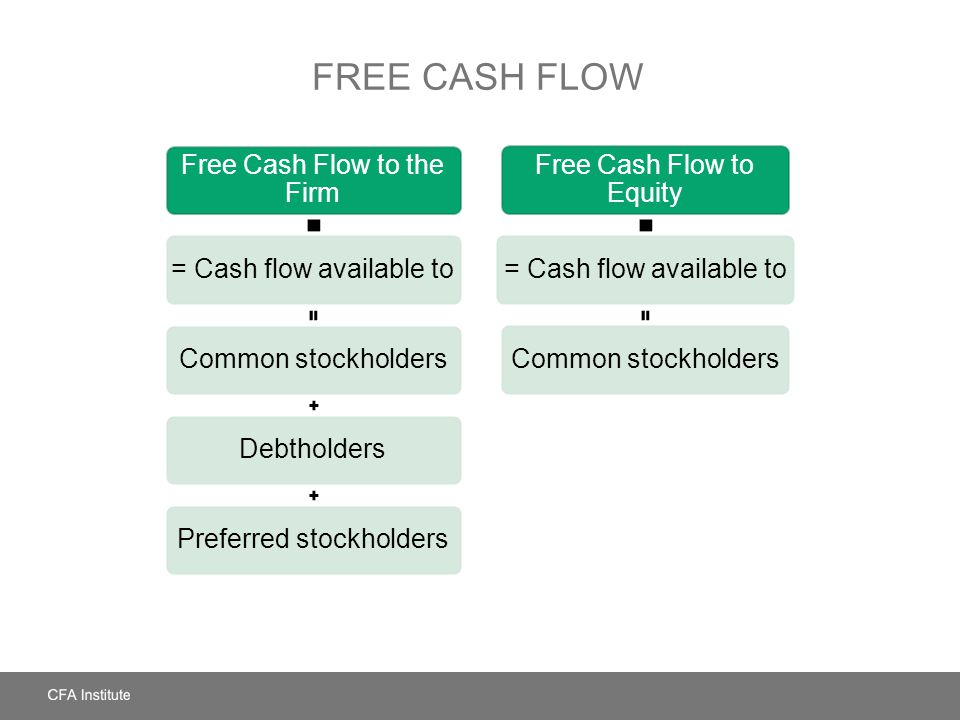

Free cash flow yield = free cash flow / enterprise value. Instead of market capitalization, it uses the price you paid for an investment as the denominator.

Free Cash Flow Valuation - Ppt Download

Divided by the stock price (so that’s your “free cash flow yield”) plus the annual rate of growth in that cash flow while still making such payments.

Free cash flow yield plus growth. The ratio of free cash flow to a company’s enterprise value (fcf/ enterprise value ). It is a good indicator to determine the investor’s payback period. We can also compare the fcf yields to bond yields.

Price data is as of 3/23/21. “purchasing this type of property right now would cost you about $500,000. Historically the s&p 500 has averaged a free cash flow yield of about 4% and cash flow has grown at 5% per year (or about the rate at which the economy has grown).

For example, if you paid $100,000 for a. The number that really matters isn’t free cash flow. (people sometimes describe this as free cash flow yield.) cash on cash yield is a different measurement often used to evaluate real estate investments.

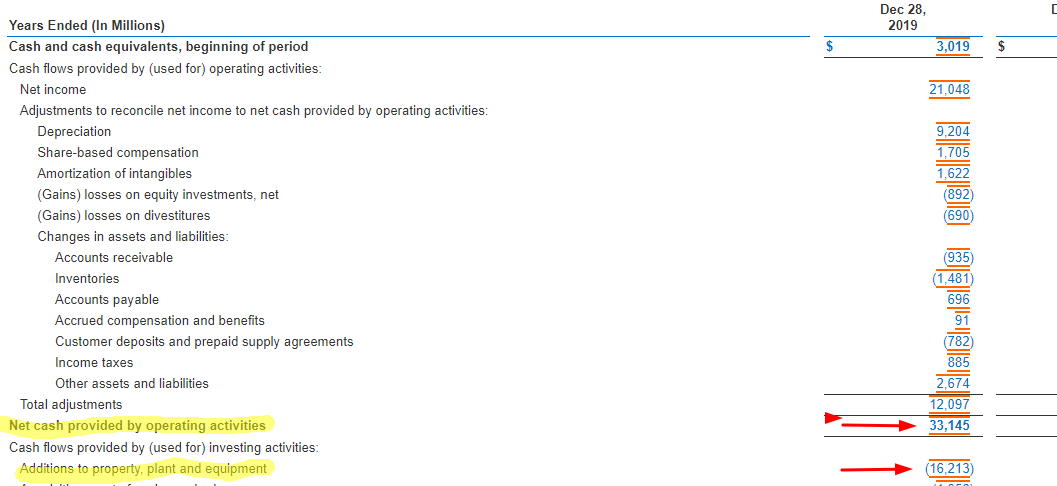

Free cash flow yield = free cash to the firm / market cap. Free cash flow yield (fcfy) we can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis: Nvidia annual free cash flow for 2020 was $4.272b , a 35.92% increase from 2019.

Assuming an inflation rate of 2.5%, the forward rate of return on an investment in the s&p 500 is about 6.5% today (2.5% free cash flow yield plus 1.5% real growth plus 2.5% inflation). What is the operating cash flow growth rate? Fcf yields > p/e multiples.

That's the ratio of free cash flow to market cap. It’s the amount of cash flow available to buy back stock, pay dividends, acquire other businesses, etc. This report analyzes free cash flow (), enterprise value and the trailing fcf yield for the s&p 500 and each of its sectors.

This is why the stock market has had an average rate of return of about 9%. A higher free cash flow yield means that the company generates more cash with the same market valuation which is good for investors. The point of this calculation is to see if the operating cash flow trend is predictable in a business.

Nvidia annual free cash flow for 2021 was $4.694b , a 9.88% increase from 2020. Fcf yield is the answer: Assuming 80% debt finance at the same rates, and consistent rental yields over the course of 10 years, the property would grow in value by around $206,000,” stone says.

This ratio expresses the percentage of money left over for shareholders compared to the price of the stock. Free cash flow yield is a financial ratio that standardizes the free cash flow per share a company is expected to earn as compared to its market value per share. Free cash flow yield = free cash flow / market capitalization.

The operating cash flow growth rate (aka cash flow from operations growth rate) is the long term rate of growth of operating cash, the money that is actually coming into the bank from business operations.

Free Cash Flow Yield - Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield - Finding Gushing Cash Flow For Future Growth

Free Cash Flow Plus Growth Investing The Warren Buffett Way - Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

Free Cash Flow Meaning Examples What Is Fcf In Valuation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Free Cash Flow Yield Explained

Free Cash Flow Yield - Finding Gushing Cash Flow For Future Growth

Free Cash Flow Explained - Newyork City Voices

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

Chapter 18 The Valuation Process A Discounted Cash

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

Free Cash Flow Valuation - Ppt Download

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Unlevered Free Cash Flow - Definition Examples Formula